Running a small business or freelance operation is hard work; and tax season often feels overwhelming. The good news? With a few smart strategies, you can maximize your tax return, reduce taxable income, and simplify your recordkeeping.

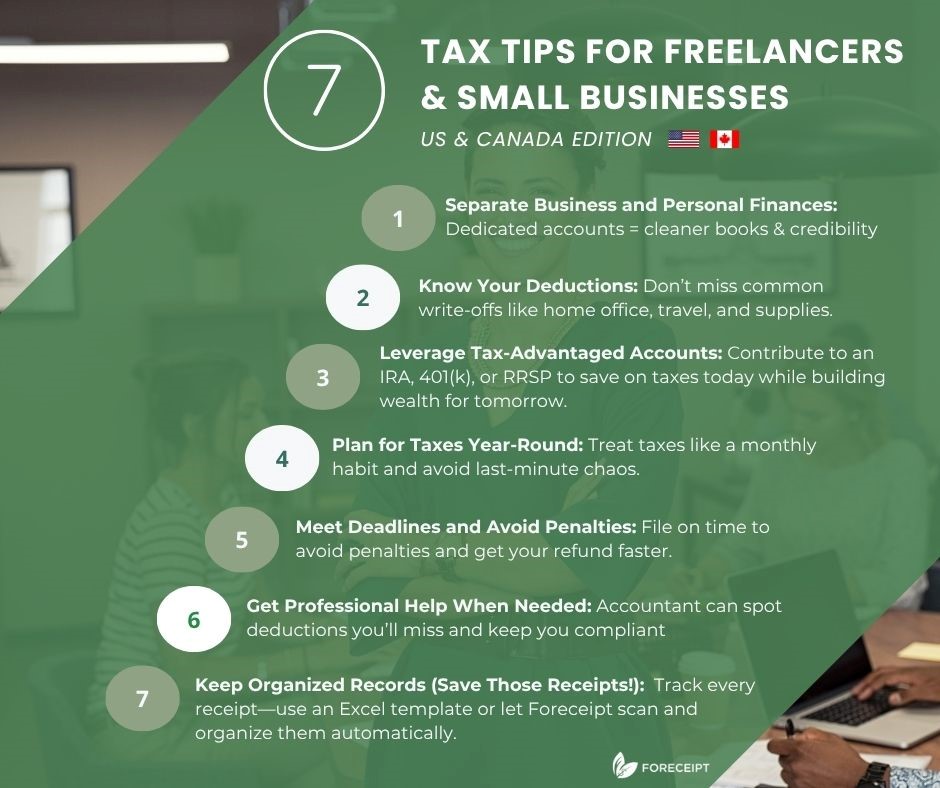

Whether you’re in the U.S. or Canada, the fundamentals are similar. Below are 7 tax tips for freelancers and small business owners that align with IRS and CRA recommendations—and help you keep more of your hard-earned money.

1. Separate Business and Personal Finances

The IRS and CRA both emphasize the importance of keeping your business finances separate. Open a business checking account and credit card to handle only company-related income and expenses. [1] [2]

- Clearer bookkeeping

- Easier to prove expenses during an audit

- Better financial insights for budgeting

👉 Pro tip: Keeping finances separate builds credibility and avoids raising red flags with tax authorities.

2. Know Your Deductions (Track Every Eligible Expense)

Every eligible deduction lowers your taxable income. Common small business deductions include:

- Home office expenses

- Office supplies and equipment

- Business travel, meals, and vehicle costs

- Internet and phone bills

- Insurance and professional fees

Both the IRS business guide and CRA’s self-employed expenses guide explain allowable write-offs in detail [3], [4].

👉 Educate yourself or consult a tax professional to avoid leaving money on the table.

3. Leverage Tax-Advantaged Accounts (Retirement Savings & More)

Contributing to retirement plans saves taxes today while building wealth for tomorrow.

- U.S. → IRA or 401(k) contributions reduce taxable income.

- Canada → RRSP contributions directly lower your income for the year.

It’s one of the simplest ways to lower your tax bill while planning for the future.

4. Plan for Taxes Year-Round

Instead of scrambling each April, treat tax planning as a year-round habit:

- Set aside money monthly for taxes.

- Time income/expenses strategically (with professional advice).

- Update books quarterly instead of waiting until year-end.

Thinking ahead means fewer surprises and potentially greater tax savings.

5. Meet Deadlines and Avoid Penalties

Both IRS and CRA charge steep penalties for late filing or payments.

- IRS → failure-to-file + failure-to-pay penalties, plus interest.

- CRA → 5% of balance owing + 1% per month late.

Filing early also speeds up refunds. Mark key dates in your calendar to avoid unnecessary costs.

6. Get Professional Help When Needed (and Use Credible Resources)

Tax codes are complex and constantly evolving. A CPA, tax attorney, or certified preparer can:

- Spot industry-specific deductions

- Ensure compliance

- Prevent costly mistakes

👉 Even the IRS suggests: “Know your limitations and know when to ask for professional help.” [5]

7. Keep Organized Records (Save Those Receipts!)

The IRS and CRA stress the importance of receipt management. Every deductible business expense must be backed by documentation [1] [6].

Options include:

- Digital tools → Use an AI-powered receipt scanning app like Foreceipt.

- DIY → Use an Excel template to record details (date, vendor, amount, business purpose). You can find one here.

With Foreceipt, you can:

✅ Snap a photo of a receipt and auto-extract details with OCR

✅ Store receipts securely in the cloud (no more shoeboxes)

✅ Search and categorize expenses instantly

✅ Generate tax-ready reports for your accountant

👉 This not only simplifies tax filing but also ensures you never miss a deduction again.

Check how Foreceipt works, and it will help you to get the most out of it.

Final Thoughts

By following these 7 best practices—separating finances, tracking deductions, leveraging retirement accounts, planning year-round, filing on time, seeking professional help, and using smart receipt management tools like Foreceipt—you’ll be well on your way to a smoother tax season.

Ready to simplify tax time?

👉 Try Foreceipt today and make receipt tracking effortless.

Smart Tax FAQ (US & Canada):

1) When are the self-employed filing deadlines?

- US: Most calendar-year filers must file and pay by April 15 (extensions give more time to file—not to pay).

- Canada: Self-employed returns are due June 15 (or the next business day if it falls on a weekend), but any balance must still be paid by April 30.

2) What form do I use to report my self-employed income?

- US: Schedule C (Form 1040) for sole proprietors.

- Canada: Form T2125 – Statement of Business or Professional Activities.

3) How long should I keep my tax records?

- US: Keep records long enough to substantiate income/deductions; generally at least 3 years, 6 years if you underreported income by >25%; keep employment tax records 4 years.

- Canada: Keep books and records for 6 years after the end of the tax year; electronic images are acceptable if readable and accessible.

- With Foreceipt you can Keep your receipts for up to 7 years.

4) Can I keep digital copies of receipts?

- US: Yes—paper or electronic is fine if your method clearly shows income/expenses and you can produce records to the IRS.

- Canada: Yes—CRA accepts properly retained electronic images and e-records.

5) What are “ordinary and necessary” business expenses?

- US: The IRS groups common deductions (e.g., advertising, supplies, professional fees) under credits & deductions for businesses; expenses must be ordinary and necessary for your trade.

- Canada: CRA lists typical business expenses (advertising, office, professional fees, etc.) and how to claim them on T2125.

References

[1] https://www.taxpayeradvocate.irs.gov/news/tax-tips/small-business-tax-highlights/2025/04/#:~:text=2,your%20business%3A%20Some%20business%20structures

[2] https://www.rbcroyalbank.com/en-ca/my-money-matters/business/managing-your-business/cash-flow-management-and-financials/business-banking-the-benefits-of-separating-business-from-personal/?msockid=08646efc706d65c63b9c7b9271c764fe

[3] https://www.irs.gov/forms-pubs/guide-to-business-expense-resources

[4] https://www.canada.ca/en/revenue-agency/services/tax/businesses/topics/sole-proprietorships-partnerships/business-expenses.html

[5] https://www.taxpayeradvocate.irs.gov/news/tax-tips/small-business-tax-highlights/2025/04/#:~:text=1,no%20matter%20who%20prepares%20them

[6] https://www.canada.ca/en/revenue-agency/services/tax/businesses/topics/sole-proprietorships-partnerships/business-records.html