July 20, 2020

If you run your own business, you have so many things to take care of. There is never enough time in the world to finish them all! The last thing you want is to scramble before the tax filing deadline because you found out that you have so many expenses to track, and they are all paper receipts – 4 boxes of them!

You accountant asked for a excel sheet with all your business expenses organized by category with tax details. Doing that manually will take days, and you might not even have excel installed in your computer.

Do you panic? Or feel terrible about yourself?

Of course not – there is a perfect solution to this problem – Foreceipt app.

Foreceipt, is your personal bookkeeper. It scans and reads paper receipts and convert them to digital records. Then you can easily export an excel sheet with all tax details and proper categories that you accountant has demanded you do. All you need to do is take photos of your paper receipts.

Here is a details run down of how Foreceipt works.

- Download Foreceipt app

The app is available for free in both Apple Store and Google Play Store.

- Scan your paper receipts with the app.

With the most updated version, you can take multiple photos at once to speed up the process. When you take photos, make sure you have proper lighting and place the receipt against a dark background.

- Review, edit and verify scan results

After taking photos, you will have the chance to review, edit and verify the details of each receipts, including expense category, tax paid, payment account etc to ensure all information is accurate. Foreceipt has one of the best scan accuracies among similar apps, so you can have peace of mind. You can even track email receipts with Foreceipt.

- Assign proper IRS or CRA expense categories

To increase your tax return or reduce tax paid back to the government, business owners needs to apply proper expense categories to each expense item in your bookkeeping. This can be confusing. Foreceipt made it easy for you! Depending on which country setting you choose, the app will provide default expense categories that are aligned with IRS or CRA. You can simply choose from the list after scanning the receipts.

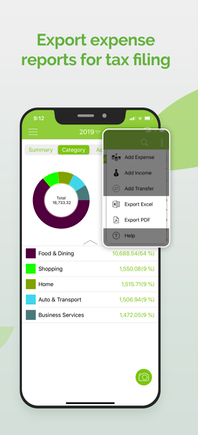

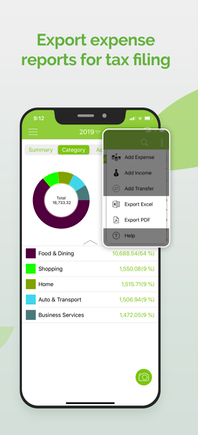

- Export excel reports and share with your accountant

Once you have all your expenses scanned and verified in the Foreceipt app, you can go ahead and generate an expense report in either excel or pdf format. Excel format is usually recommended for easier editing. Your expense will be automatically categories with the expense categories required by IRS or CRA. Send this expense report to your accountant, he/she will be thrilled! You probably save some accounting fees too.

- Keep a copy of your digital receipts

In case of audit, you can use the digital images saved in Foreceipt as a proof of your expense. No need to keep all your paper receipts for 7 years! With the Prime Plans, Foreceipt will keep your digital receipts for 7 years, as is required by the tax bureaus.

Now, start tracking your expenses digitally with Foreceipt and get rid of your shoeboxes full of paper receipts!