June 16 Tax Deadline for Canadian Self-Employed: How to Stay Organized and File on Time

If you’re self-employed in Canada, June 16, 2025 is a critical date to mark on your calendar. While most Canadians file their taxes by April 30, self-employed individuals (and their spouses or common-law partners) get an extension until June 15 to file their income tax return. Because June 15 falls on a Sunday this year, […]

June 16 Q2 Estimated Tax Deadline for U.S. Freelancers and Small Business Owners: How to Stay Organized and Pay On Time

If you’re self-employed in the U.S., there’s an important tax deadline coming up: Monday, June 16, 2025. This is the due date for your Q2 estimated tax payment to the IRS. Because June 15 falls on a Sunday this year, the IRS considers payments made by Monday the 16th to be on time. If you’re […]

5 Post Tax Season Tips to Organize Receipts and Manage Mid Quarter Expenses

Congratulations! You made it through tax season — whether you’re in the U.S. or Canada, that’s no small feat. As the paperwork clears and the coffee-fueled late nights wind down, early May is the perfect time to reset. With the second quarter well underway, it’s an ideal moment to take stock of your financial habits, […]

4 Quick Tips to Take the Guesswork Out of Delving Into Entrepreneurship

As an entrepreneur-in-the making, you may already be familiar with the long list of tasks you’ll need to complete in order to take the final plunge into entrepreneurship. From choosing a business structure and location to investing in the right types of office essentials for your entrepreneurial goals, there’s a whole lot to think about […]

How To Have A Successful Tax Season: Advice From A Professional Accountant

Lessons & Advice From a Did you know that many business owners risk throwing away their money in tax season? Many self-employed individuals either don’t track their receipts or leave them disorganized, which results in potentially paying additional tax as they may not have the documentation required to support their expenses. If you’re not keeping […]

Make expense tracking a productive group effort with Team Collaboration.

Foreceipt is constantly innovating the way we approach managing finances and scanning receipts. With our newest Team Collaboration features, we’ve expanded what you can do with our service while making your team more united than ever before. Keeping your team more productive than ever before while saving money will have you starting the new year […]

How to Quickly Convert Paper Receipts to an Excel Sheet?

July 20, 2020 If you run your own business, you have so many things to take care of. There is never enough time in the world to finish them all! The last thing you want is to scramble before the tax filing deadline because you found out that you have so many expenses to track, […]

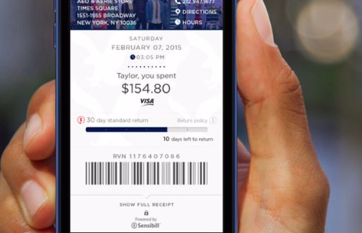

Step-by-step Guide for Small Business to Generate Expense Report for Tax Filing using Foreceipt App

July 27, 2020 Filing for tax is one of the more critical tasks for small business owners and self-employed workers. The main final output for tax return is to prepare expense reports, which can be automatically generated in Foreceipt’s web portal. Since there is an instant sync between mobile app and web portal, don’t worry about […]

How to Track Email Receipts Automatically for Small Business?

Paperless receipts, especially email receipt, have become increasingly popular among business that are environmentally conscious. There are many benefits of using digital receipts, including increase productivity, remove paper receipts, easy to search and easy to store etc. Digital receipts are normally sent via e-mail or via an app. Unlike paper receipts, e-receipts are used to reduce paper usage. The e-receipt helps to connect customers […]